A Better Way To Build Wealth

Why Multifamily?

#1: Recession Resilient. Because housing is an inherent need, multifamily real estate performs much better than other asset classes in an economic downturn. This was seen both in the 2008 Great Recession and the 2020 COVID Recession.

#2: Capital Appreciation. Because we implement a value add business plan on all of our properties, we’re able to consistently force appreciation, which augments natural market appreciation that happens over time.

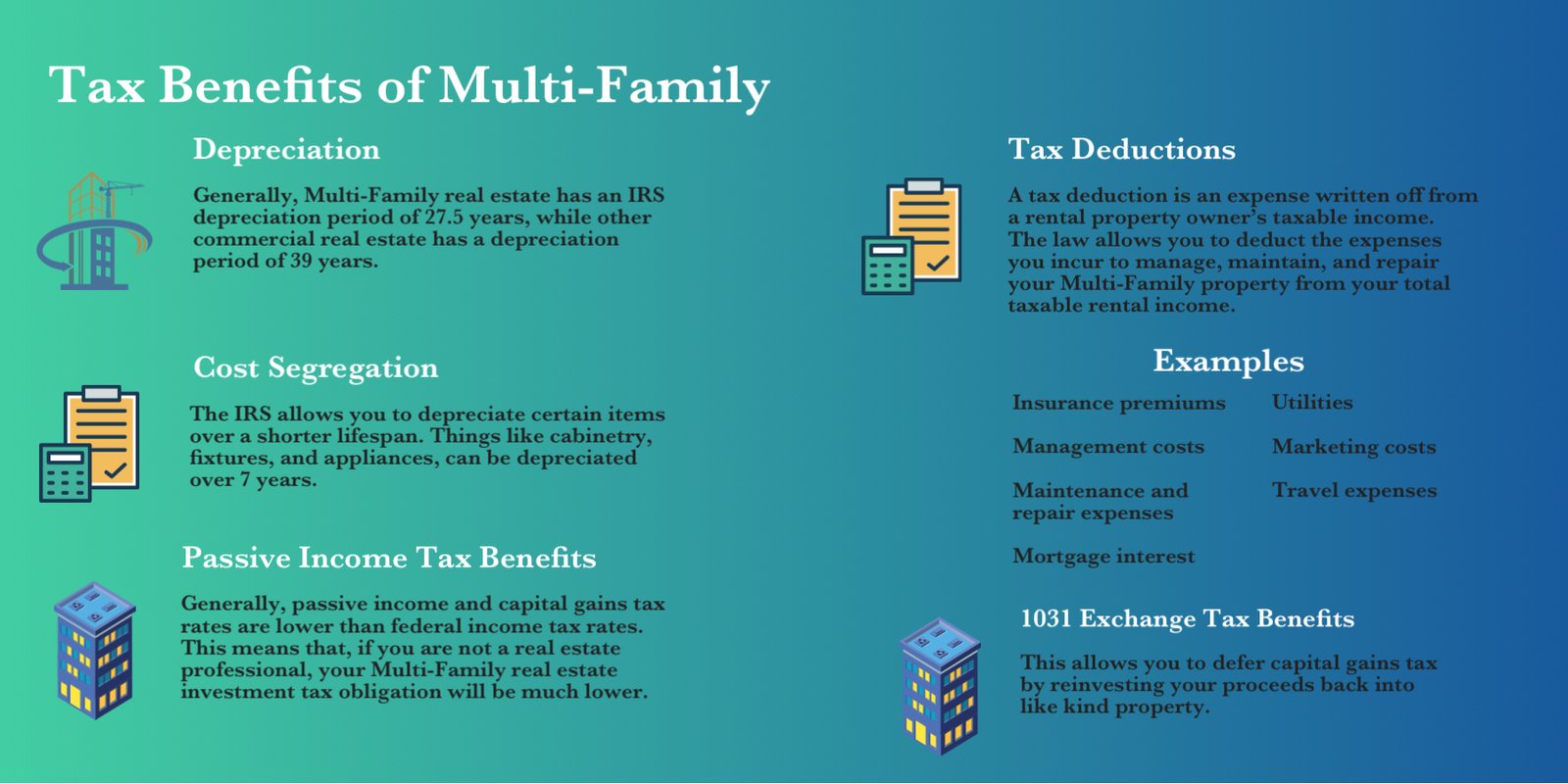

#3: Tax Advantages. By completing a cost segregation study on all of our properties, we are able to leverage bonus depreciation which reduces the tax liability for us and our investors.

#4: Declining Home Ownership Rates. Due to current high interest rates and long term trends in consumer behavior, renting is becoming more and more popular.

Why Texas?

#1: Favorable Demographic Trends: Rapid population and job growth.

#2: Favorable Regulation Trends: Development-friendly policies that allow us to complete construction quicker with fewer headaches and risks

#3: Supply-Demand Imbalance: Current construction volume unable to keep up with increasing demand makes for an excellent investment opportunity.

Why Class A?

Simply put, Class A properties attract the highest quality tenants.

Tenants with high paying jobs and good credit that consistently pay their rent on time.

This allows us to achieve the highest returns while giving our investors the most security.

If you have any questions about how we find the best deals that get the highest returns, click here to book a call with me.

I’d love to get to know more about you and your goals, and see if what we offer is a good fit.